Contents:

At this meeting, the Fed announced it would once again raise the target fed funds rate by 50 basis points. The FOMC statement noted many concurrent factors, including soaring inflation, the situation in Ukraine, and supply and demand pressures related to the pandemic. During its December meeting, the FOMC raised its target for the federal funds rate 50 basis points to a range of 4.25% to 4.50%. The Federal Open Market Committee is the branch of the Federal Reserve that meets eight times each year to discuss and make decisions about monetary policy.

After setting interest rates to zero in response to the COVID-19 pandemic, the Fed stated it would raise rates throughout 2022 in order to curb inflation, which had reached 8.5% by March 2022. AxiTrader Limited is amember of The Financial Commission, an international organization engaged in theresolution of disputes within the financial services industry in the Forex market. As volatility tends to pick up during FOMC meetings, and the cost of trading is increasing, it is important traders are aware of the meetings schedule. Secondly, traders will try to get an understanding about the what the market is expecting from the event. Furthermore, they might do their own analysis and come to their own conclusion as to how the FOMC meeting could affect markets.

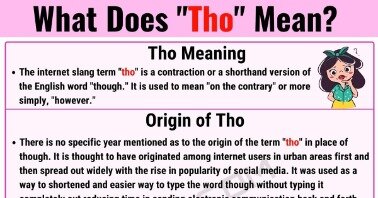

FOMC Meeting Minutes

Global inflation came in at a six-month low in December but the Federal Reserve maintains that it is unlikely to reverse its hawkish bias. The FOMC Meeting Minutes are a written record of the presentations and discussions of the previous FOMC meeting. They are released to the public three weeks after each scheduled meeting. Included are summaries of policy decisions, economic forecasts, and dissenting opinions of the FOMC members. The Federal Open Market Committee is the policy-making body of the U.S.

British Pound (GBP/USD) Forecast Led by US CPI, FOMC Minutes and Gov Bailey – DailyFX

British Pound (GBP/USD) Forecast Led by US CPI, FOMC Minutes and Gov Bailey.

Posted: Wed, 12 Apr 2023 07:36:18 GMT [source]

The target rate is maintained by open market operations and interest rates on reserves. Changes to the federal funds rate can have a significant impact on a variety of financial markets, both short and long term. Lastly, the economy has defied expectations for some time now, growing faster than expected with strong job growth despite rising rates. If that picture changes, then the Fed may become a little more cautious on raising rates as the downside risks for the economy increase. © 2023 Bloomberg Finance LPFor the first half of 2023 the Fed’s remaining decision will come on on March 22, May 3 and June 14 with the interest rate announcement coming at 2pm ET and a press conference at 2.30pm ET.

https://www.federalreserve.gov/newsevents/pressreleases/monetary20220105a.htm

The FED has done more harm to the dollar than all counterfeiters in history. In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more. A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. As a senior writer at AOL’s DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

Fed meeting schedule 2023: A look at this year’s calendar – USA TODAY

Fed meeting schedule 2023: A look at this year’s calendar.

Posted: Tue, 13 Dec 2022 08:00:00 GMT [source]

Inflation has been steadily subsiding as a result of the extremely aggressive monetary policy of the Federal Reserve which has been raising the benchmark “Fed funds” rate beginning in March 2022. The Federal Reserve had maintained its benchmark rate between 0 and ¼% for an extended time even though inflation in 2021 was spiraling out of control quickly approaching a 40-year high. Beginning in March the Federal Reserve raise rates by ¼%, the first-rate hike since 2018. At the meeting, the FOMC members discuss monetary policy changes, developments in financial markets, asses the current state of the economy, present their economic outlook and discuss open market operations.

Heightened uncertainty among consumers caused U.S. retail sales to fall 1% in March vs the previous month. That marked the fourth time retail sales declined in the past five months. “When is the next Fed meeting?” is a question that hasn’t weighed this heavily on anxious investors’ minds in probably four decades. This means that Fed may reach a point to hold rates steady around the spring. However, some fear that prospects of a recession, will mean that the Fed may feel the need to cut rates later in 2023.

Countdown begins to Fed

With the March rate hike, the Fed made it clear that the fight against inflation takes precedence over troubles in the banking sector. It remains to be seen if the FOMC maintains such a stance in May. For the record, the central bank’s rate-setting committee is called the Federal Open Market Committee . There’s a saying on Wall Street that the Fed stops hiking rates when something breaks. But what spooked depositors in the first place was the fact that SVB had so much of its capital essentially trapped in Treasury bonds, the prices of which fall when interest rates rise. The Fed will announce interest rates in 2023 on the following dates, with the announcement coming at 2pm Eastern Time.

Read more about how introducing brokers operate for Axi in this guide. These include, but are not limited to, a plan to establish a joint force HQ in the Indo-Pacific Command area of operations, a report on the UN arms embargo on Iran, and a multi-year plan to fulfill Taiwan’s defensive requirements. December 31 – Section 702 of the Foreign Intelligence Surveillance Act—which authorizes the collection of intelligence on overseas foreign targets from communication infrastructure in the United States—expires. August – The National Labor Relations Board is expected to propose a rule concerning joint employers.

lotro survey markers of the dwarf-holds

It does not constitute financial, investment or other advice on which you can rely. Any references to past performance, historical returns, future projections, and statistical forecasts are no guarantee of future returns or future performance. Plus500 will not be held responsible for any use that may be made of this information and for any consequences that may result from such use.

In 2023, there won’t be any https://forex-world.net/ announcements in January, April, August and October. Of course, the Fed can set rates whenever it wishes, but we’ll only see rate decisions in these months if something more dramatic happens to the economy. Another increase came in May, this time by 0.50 percentage point, followed by 0.75 percentage point hikes for four consecutive meetings. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. All statistics in this calendar are in expressed in nominal terms unless labeled “real.” “Real” statistics are inflation-adjusted using the most relevant deflator.

- Of course, the Fed can set rates whenever it wishes, but we’ll only see rate decisions in these months if something more dramatic happens to the economy.

- This directly affects the value of your retirement portfolio, the cost of your next mortgage, the selling price of your home, and the potential for your next raise.

- Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only.

- The Federal Reserve Systems is governed by the board of governors or Federal Reserve Board .

- The main question will be how the Fed handles the transition to to an expected pause in rates.

- A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance.

Unrivalled Central Bank Policy coverage across G7 and China, delivering exclusive interviews with leading policymakers. We cut through the noise to convey the true policy message that impacts FX and Fixed Income markets. Exclusive interviews with leading policymakers that convey the true policy message that impacts markets. Dimitar got interested in cryptocurrencies back in 2018 amid the prolonged bear market.

Crypto

It decided to continue purchasing new securities to replace its holdings. However, it would not increase or replace them when they matured once the fed funds rate reached 2%. The FOMC, concerned about slowing growth, reversed course and switched to expansionary monetary policy in 2019. The Fed released updated projection materials and maintained economic projections through 2024.

It is scheduled to meet five to eight times annually, with the intent of addressing the current state of the U.S. economy. Decisions are made regarding the management of the USD, including interest rate adjustments and the purchase/sale of U.S. government debt. The FOMC cannot directly tell banks at which rate they should lend money to other banks.

The calendar also has customizable features allowing the user to tailor the display to their requirements and also individual trading timezones. Bitcoin’s price swings were evident each time the central bank of the USA adjusted the interest rates. When the institution raised the benchmark by 0.5% in December, the primary cryptocurrency tumbled from $18,300 to $17,850 in a matter of minutes. The FOMC influences interest rates when it changes the FFR range.

Focuses on trading flows, central bank activity, FX options and cross-asset flows. On the contrary, BTC spiked above $20,500 when the Fed increased the interest rates by 75 basis points in November. The Fed would taper another $10 billion a month from its Treasury notes and mortgage-backed securities purchases. Most of the FOMC meetings in 2020 responded to economic threats posed by the COVID-19 pandemic. The Fed committee stated that they would continue to keep an eye on the jobs picture, and would be willing to adjust their strategy if risks emerged. The Federal Open Market Committee holds eight scheduled meetings per year.

AxiTrader is 100% owned by AxiCorp Financial Services Pty Ltd, a company incorporated in Australia . Over-the-counter derivatives are complex instruments and come with a high risk of losing substantially more than your initial investment rapidly due to leverage. You should consider whether you understand how over-the-counter derivatives work and whether you can afford to take the high level of risk to your capital. Investing in over-the-counter derivatives carries significant risks and is not suitable for all investors.

The meeting minutes give you a high-level analysis of the U.S. economy. That makes them useful to read even if the FOMC doesn’t change interest rates. The stock market often reacts immediately to FOMC meetings, announcements, and minutes. As well as being a trader, Milan writes daily analysis for the Axi community, using his extensive knowledge of financial markets to provide unique insights and commentary.

Within the dates above, the announcements in Fomc meeting calendar, June, September and December may be considered more insightful by markets. This is because at these meetings the Fed will provide a summary of its economic projections. © 2022 Bloomberg Finance LPThe U.S. Federal Reserve will meet to set interest rates eight times in 2023. The main question will be how the Fed handles the transition to to an expected pause in rates. Interest rate futures suggest that the Fed will set and hold short-term rates in a 4% to 5% band for much of 2023, though we could see rate cuts in 2023 if the economy weakens.

He’s also written for Esquire magazine’s Dubious Achievements Awards. The March figures did, however, come in slightly below economists’ average forecast, which relieved at least some pressure on the Federal Reserve. Don’t forget that the February jobs report and the January jobs report blew away economists’ and market participants’ expectations.

The FOMC, assured that the recession was over, reversed course and began imposing contractionary monetary policy to prevent inflation. In addition, it seems that the Fed’s latest decision has also put pressure on banking stocks, which have already been making the headlines numerous times this month. Major banks like JPMorgan and Bank of America both slid by 2.6% and 3.2% respectively on Wednesday. Nonetheless, while the rate hike may have been gloomy news to many market sectors, the EUR/USD, one of the most traded Forex pairs in the world, rose by 0.34% as of the time of the writing. In addition, Gold , too seemed to have benefitted from this monetary decision as it gained 0.28% as of the time of the writing. In times of economic strife, the FOMC tends to recommend buying securities in order to support economic growth; the inverse is true when the national economy seems to be on more stable ground.

The March and June meetings will be relatively more informative as the Fed will provide updated economic projections. The Fed only schedules eight meetings a year, and so does not meet in April. The market currently expect rates to increase 0.25-percentage-points at each of these upcoming three meetings, and the Fed may then hold rates steady for the second half of the year. It is widely expected that the Federal Reserve will continue its pivot by slowing the pace of rate hikes with a ¼% rate hike during the January FOMC meeting. The CME’s FedWatch tool currently is forecasting that there is a 98.1% probability that the Fed will raise rates by only ¼% and a 1.9% probability that the Fed will raise rates by ½ %.

Other experts argue that another quarter-point increase is necessary to curb inflation and, perhaps more importantly, maintain the Fed’s credibility. The Fed will also publish the minutes of its meeting, three weeks after each meeting has taken place. These minutes can provide more color on the Fed’s thinking and key areas of debate and uncertainty. The median forecasts in this calendar come from surveys of economists conducted by Dow Jones Newswires and The Wall Street Journal. Outsourced Chief Investment Officer service to institutional investors.

Others will rely on analysis from professional market analysts or expert traders. Its been a month since the last post…and now the feds n u t s are absolutely in a vise grip. You are either going to have permanent inflationary damage and/or crippling recessionary/debt pressures. Most likely a combination of both…and there is nowhere to hide. The FED is a cartel in that it sets interest rates below the rate of inflation instead of letting the free market set the rates.